Gifts of Real Estate

From farmland and timberland to vacation residences and rental properties, a gift of real estate can unlock the full value of your property and offer special economic advantages. If you own property not subject to a mortgage that has appreciated in value, a charitable gift to the Marian Foundation may be an attractive proposition. The following options are frequently used by friends of the hospital:

- An outright gift of appreciated property offers maximum tax advantages because the charitable deduction is generally based on the full fair market value of the property. An appraisal is needed for IRS purposes.

- A gift of the remainder interest in your home or farm (called a “retained life estate”) can provide a current tax deduction, avoid capital gains taxes, and allow you to continue to live in your home.

- A gift (or partial interest) of appreciated property can be used to create a charitable remainder trust, which will provide you (and/or you and a second beneficiary) an annual income for life.

Why Fund a Charitable Gift with Real Estate?

Unless you sell the property, your options for receiving current financial benefits from the real estate are usually limited to increasing your debt or renting the property to someone else.

Real property can also be a nuisance for estate planning, since it is rarely practical to transfer a single property to more than one heir. The result is a choice between leaving inequitable benefits for heirs or placing the burden—and costs—of selling the property onto your executor and estate. Property located in different states may be subject to additional probate and transfer costs.

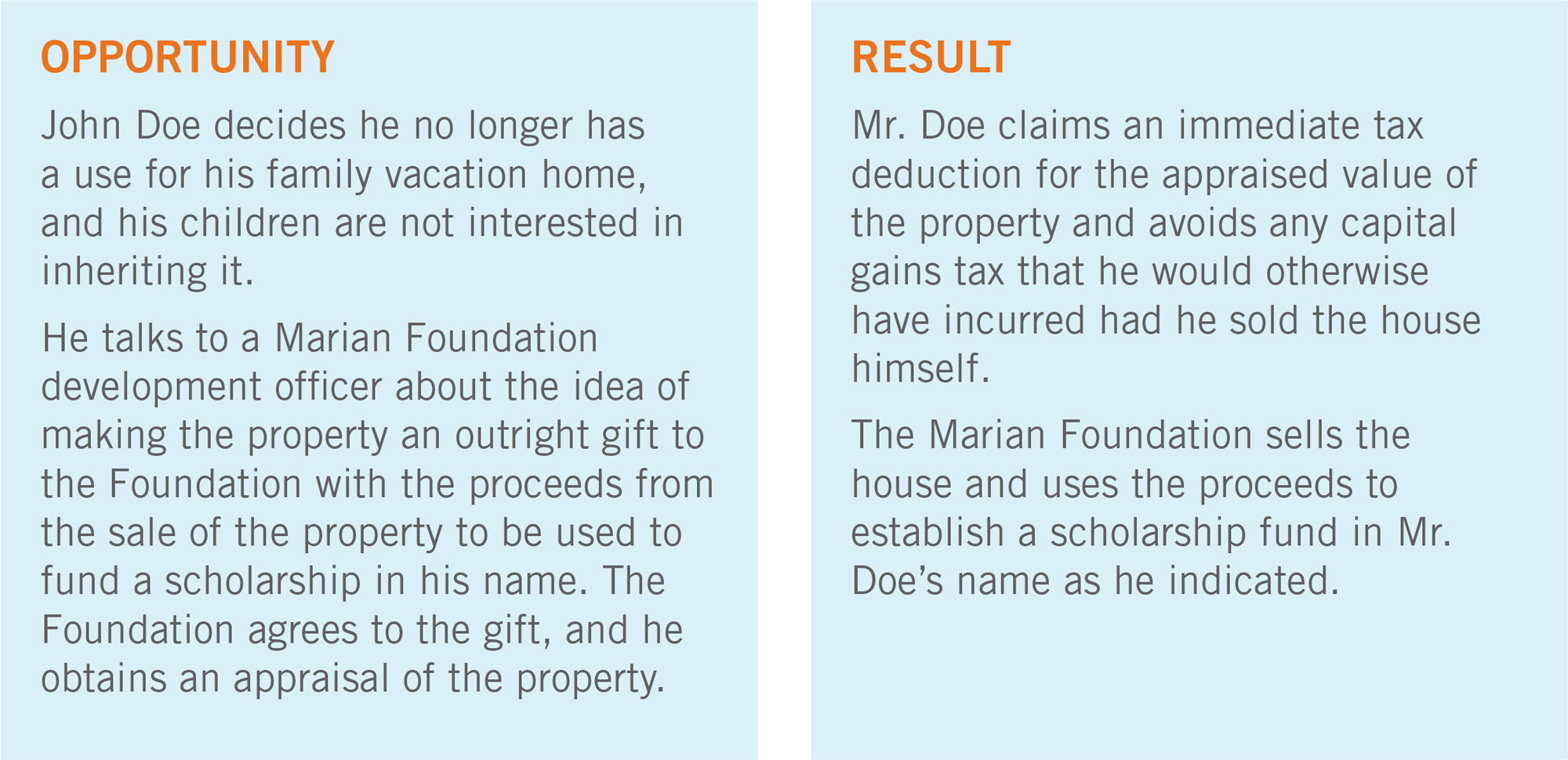

Make an Outright Gift

You may deed your property to the Marian Foundation and gain an income tax deduction for the appraised value of the property. If you wish, you may then designate how the proceeds are to be used by the hospital.

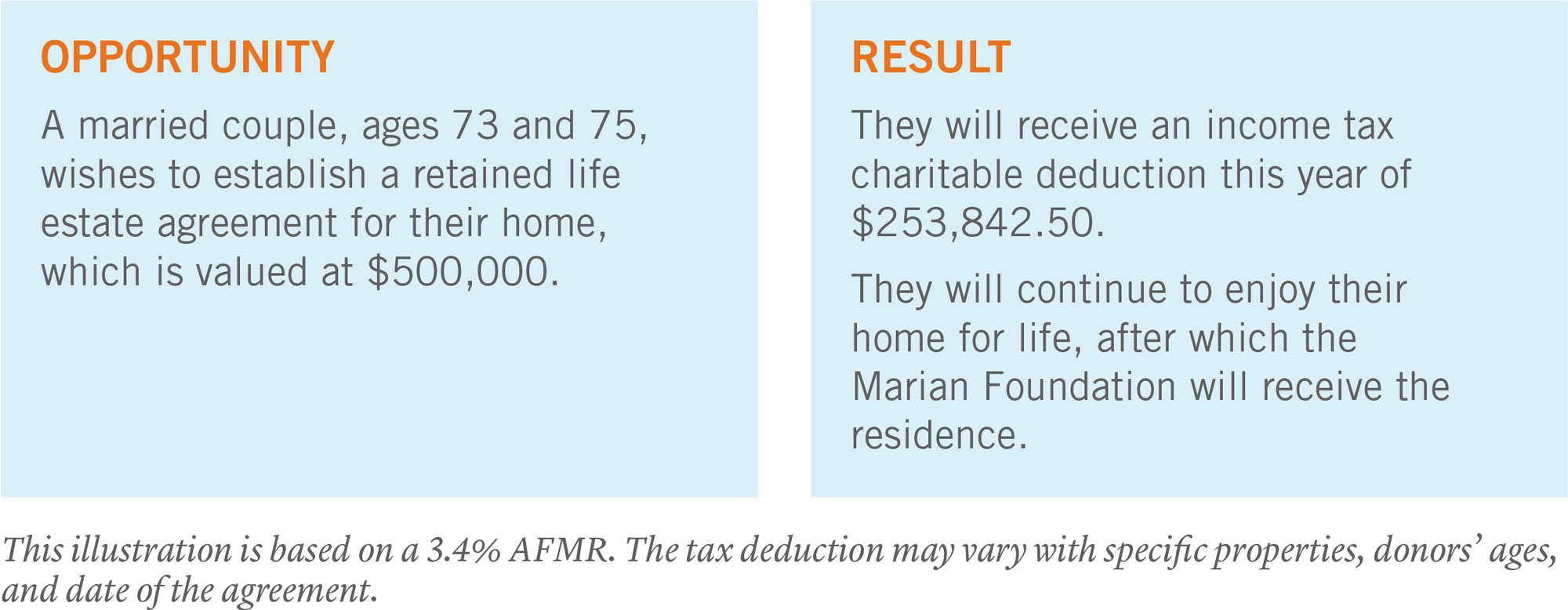

Give Your Property and Continue to Enjoy It

The retained life estate agreement is an opportunity to continue living in or using your home, vacation home, or farm while also establishing a gift now—and to enjoy the benefits, including current tax savings, that usually characterize only lifetime charitable gifts. While nothing changes in your current lifestyle or your use of the property, the retained life estate arrangement generates a sizable income tax deduction for you in the year you establish the gift. At the end of the retained life estate term (usually your lifetime or joint lifetimes), the property goes to the Marian Foundation as the charitable recipient. The donor is responsible for all taxes, maintenance, etc., on the property during their lifetime.

What if I Depend on the Property for Income?

A retained life estate agreement will allow you to continue using the property productively or renting it to others during your lifetime. You can then enjoy the income tax savings immediately or save it for the future or for your heirs.

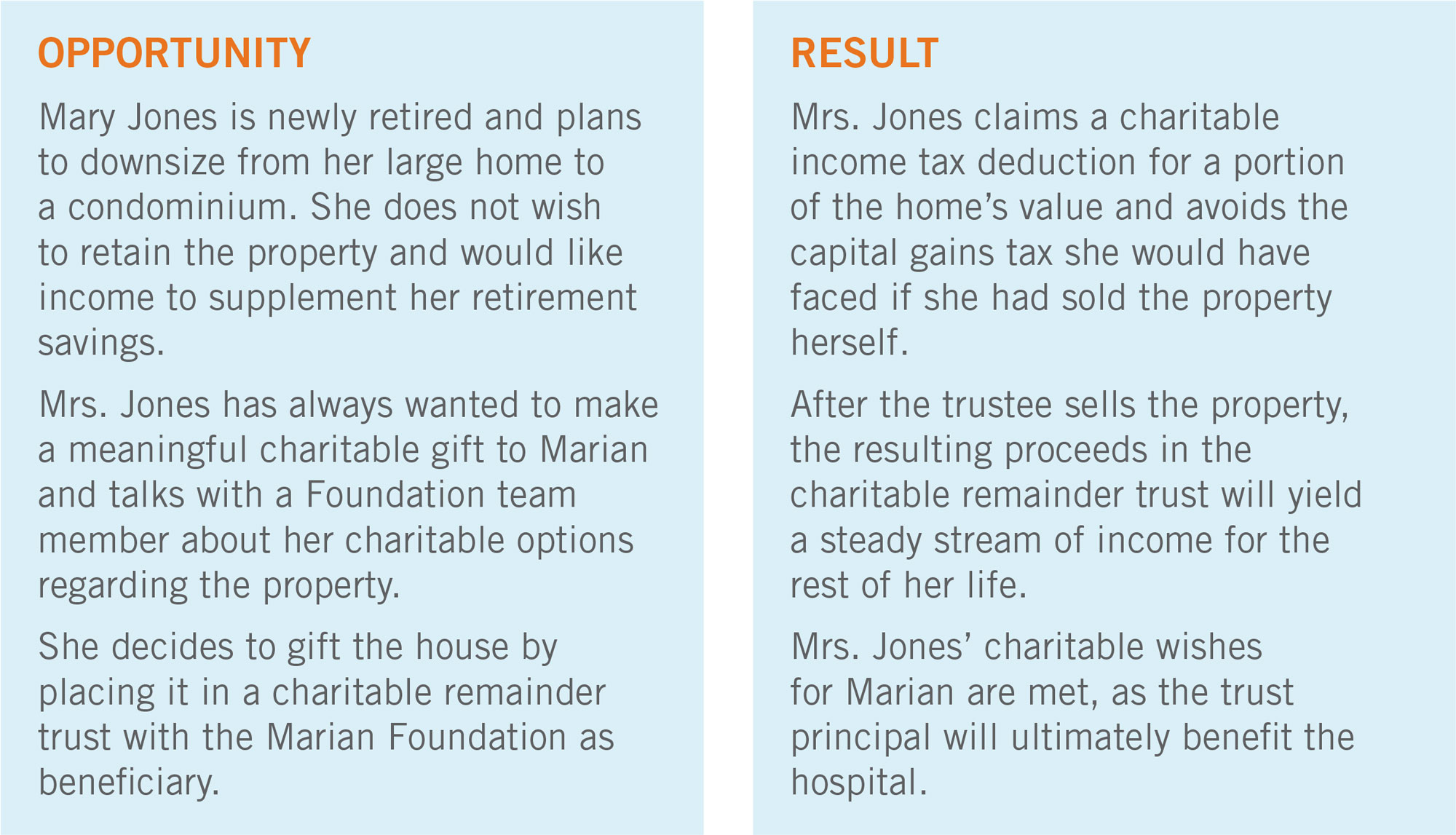

A Gift that Yields an Income Stream

It is possible to generate or replace income from real property (while avoiding or reducing capital gains taxes on the sale of the asset) through a charitable remainder trust. In this scenario, the donor must put the property into a trust before there is a signed purchase offer on the property by a third party.